All about Estate Planning Attorney

Table of ContentsThe Of Estate Planning AttorneyEstate Planning Attorney - TruthsMore About Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Buy

Estate preparation is an action strategy you can make use of to establish what occurs to your possessions and commitments while you're active and after you die. A will, on the other hand, is a lawful paper that lays out just how possessions are dispersed, who deals with kids and family pets, and any other wishes after you die.

The administrator also needs to settle any kind of tax obligations and financial obligation owed by the deceased from the estate. Lenders usually have a restricted amount of time from the date they were alerted of the testator's fatality to make cases versus the estate for cash owed to them. Cases that are turned down by the executor can be taken to court where a probate judge will certainly have the last word regarding whether or not the claim stands.

Estate Planning Attorney Can Be Fun For Everyone

After the stock of the estate has been taken, the value of possessions calculated, and tax obligations and financial obligation settled, the administrator will certainly then look for consent from the court to distribute whatever is left of the estate to the recipients. Any inheritance tax that are pending will certainly come due within nine months of the day of fatality.

Each individual places their assets in the trust and names somebody various other than their partner as the beneficiary. A-B depends on have actually come to be less prominent as the estate tax obligation exemption functions well for a lot of estates. Grandparents might move assets to an entity, such as a 529 strategy, to sustain grandchildrens' education.

Not known Facts About Estate Planning Attorney

Estate coordinators can collaborate with the contributor in order to lower taxed earnings as an outcome of those payments or develop strategies that make best use of the result of those contributions. This is an additional method that can be used to limit death tax obligations. It involves an individual securing the present worth, and hence tax obligation, of their residential property, while attributing the worth of future growth of that resources to one more person. This method includes freezing the value of a possession at its value on the day of transfer. Appropriately, the amount of prospective capital gain at fatality is also iced up, allowing the estate coordinator to estimate their prospective tax obligation responsibility upon death and better plan for the repayment of earnings taxes.

If enough insurance coverage earnings are readily available and the policies are properly structured, any kind of revenue tax obligation on the regarded personalities of possessions adhering to the fatality Get More Information of a Click This Link person can be paid without turning to the sale of properties. Earnings from life insurance policy that are received by the beneficiaries upon the fatality of the guaranteed are generally revenue tax-free.

There are certain files you'll require as component of the estate preparation procedure. Some of the most usual ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth people. Yet that's not real. As a matter of fact, estate preparation is a device that everyone can utilize. Estate intending makes it much easier for individuals to identify their wishes prior to and after they pass away. Contrary to what the majority of people think, it extends beyond what to do with assets and obligations.

The Ultimate Guide To Estate Planning Attorney

You ought to start preparing for your estate as quickly as you have any measurable possession base. It's a continuous process: as life progresses, try this website your estate plan should shift to match your conditions, according to your new objectives. And maintain it. Refraining from doing your estate planning can cause unnecessary monetary concerns to liked ones.

Estate preparation is usually taken a tool for the wealthy. That isn't the instance. It can be a helpful means for you to take care of your properties and responsibilities before and after you die. Estate preparation is likewise a wonderful method for you to set out strategies for the care of your small children and animals and to outline your long for your funeral service and favored charities.

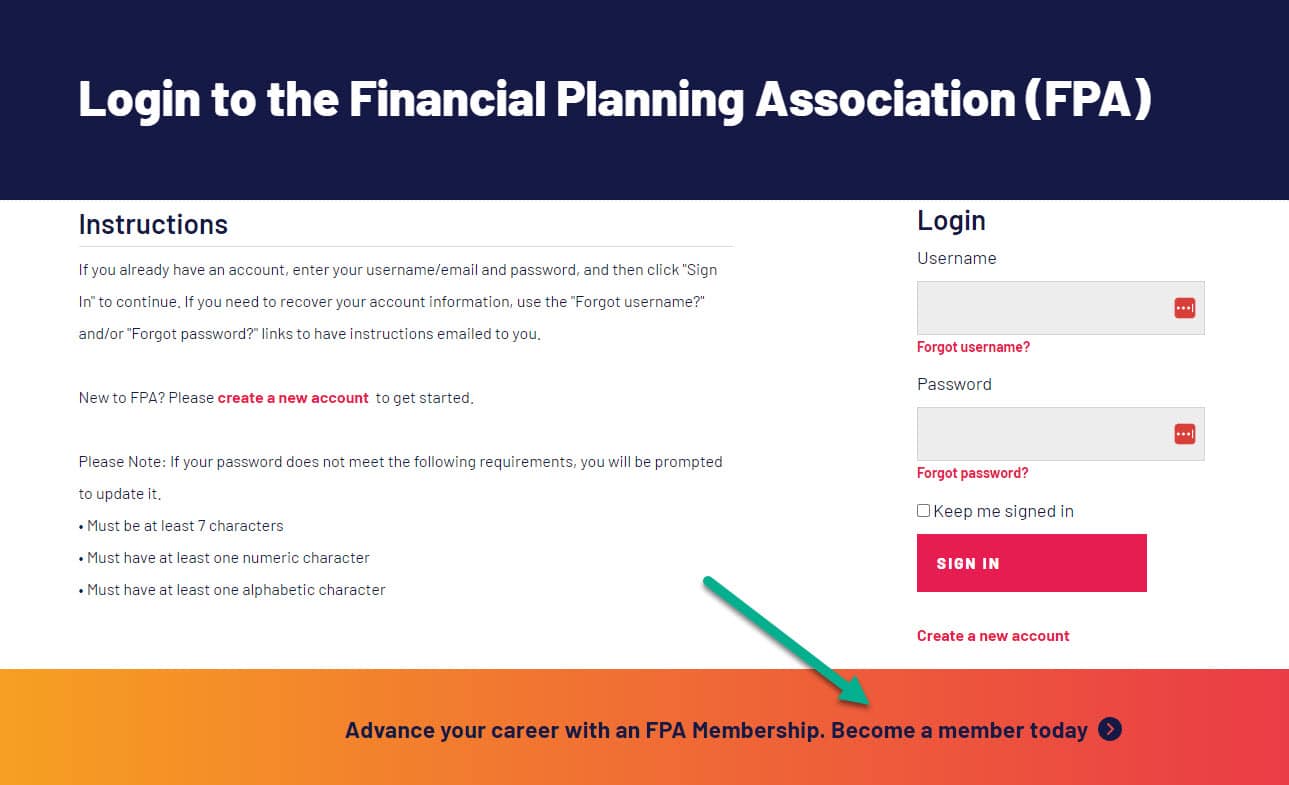

Applications need to be. Eligible applicants that pass the test will be officially accredited in August. If you're eligible to sit for the test from a previous application, you might submit the brief application. According to the policies, no certification will last for a period longer than 5 years. Learn when your recertification application is due.